News

General News

Gauteng Regional Networking Event – 14 March 2024

Manufacturing activity likely to remain depressed for longer

Manufacturing activity in South Africa could remain depressed for longer after sentiment plunged to its 10th consecutive month of decline amidst deteriorating business conditions.

The Absa Purchasing Managers’ Index (PMI) rose to 48.2 in November, up from 45.3 in October, but still marking the 10th consecutive month of contraction in factory activity.

This was the first increase following two months of a decline in the headline index, although the index failed to return to positive terrain above the 50-points mark which separates contraction from expansion.

The PMI is an economic activity index based on a survey conducted by the Bureau for Economic Research (BER) and sponsored by Absa.

The monthly surveys are conducted under a representative group of purchasing managers in the South African manufacturing sector.

More on this

- Privatisation of its parastatals may improve economy

- Load shedding – China provides emergency generating support for South Africa

- SUV sales ‘offset’ carmakers’ electric gains, Greenpeace says

The BER said that the business activity and new sales orders indices both continued to indicate declining activity and demand, albeit at a slower rate than before.

The business index rose by 5.7 points, from 40.3 to 46 points, but still stuck in contractionary terrain for a 10th straight month.

While demand improved somewhat in November, the BER said the ramp-up in the intensity of load shedding towards the end of the month may have curtailed activity growth.

However, an encouraging development was the solid improvement of 6.9 points in the new sales orders index, from 39.7 to 46.6 points in November.

BER senior economist Lisette IJssel de Schepper said the new sales orders index rose to the best level since early this year following a few months of signalling very depressed underlying demand, but it still pointed to weakening demand though the rate of the decline has slowed.

“While these solid improvements are encouraging developments and point to some recovery in underlying demand filtering through to better activity, there are some worrying signs in the survey results,” de Schepper said.

“These include the fact that higher activity did not filter through to the employment index, which remained largely unchanged at a low 41.1 index points in November.

“Another concern is that the congestion at South Africa’s ports is seemingly resulting in a slower delivery of supplies. Respondents note that the unavailability of inputs required could hurt production abilities and push up costs.

“Exports were also under pressure. Worryingly, it seems like it will take at least a few months for the disruptions at the harbours to clear up, which means that this could have a lingering negative impact on the sector.”

The expected business conditions index declined further in November and is now at its weakest level since the strictest months of South Africa’s COVID-19 lockdown in 2020.

Following a significant 12.2-point decline in October, the index lost a further 2.4 points to reach 41 in November.

The BER said this meant that purchasing managers expected business conditions to deteriorate in six months.

Beyond issues with logistics, the BER said the recent ramp-up in the intensity of load shedding, following some weeks of respite, may also have depressed forward-looking sentiment.

Investec economist Lara Hodes concurred that the PMI outcome was still indicative of a subdued manufacturing sector grappling with a number of challenges, notwithstanding November’s modest improvement.

Hodes said a ramp up in production for Black Friday and the festive period likely contributed to the notable rise, but worryingly was the slower delivery of supplies as a result of the congestion at South Africa’s ports.

“Export activity was also lacklustre during the month. The significant logistical constraints, coupled with the subdued state of the global manufacturing sector continue to weigh on export potential,” Hodes said.

“According to results from the latest HCOB Eurozone Manufacturing PMI, released today, the region’s manufacturing sector remained mired in a downturn during November.”

Manufacturing activity likely to remain depressed for longer (iol.co.za)

Electric Vehicle White Paper released!

NAACAM welcomes the Department of Trade, Industry and Competition’s (the dtic) release of the Electric Vehicle (EV) White Paper. The first phase of the EV roadmap will focus on developing the productive capacity of the domestic industry to support the EV transition. In this regard, Minister Patel outlined key actions to be undertaken to support this approach at a media briefing this morning. This includes:

- Increasing the levels of investment and funding to catalyse EV investment in automotive assembly and component manufacturing.

- Facilitating and developing an electric battery regional value chain

- Temporarily reducing import duties for batteries in vehicles produced and sold in the domestic market.

- Securing or maintaining duty-free market access for vehicles and components produced in SA.

- Leveraging R&D tax incentives to deepen domestic value addition.

- Commercializing green hydrogen production as a sustainable fuel.

- Implementing energy reforms

- Implementing reforms to network industries, including freight and rail.

- Refurbishing the rail line between Gauteng and Ngqura.

- Developing an EV certification programme for skills development.

Ramaphosa concerned developed countries not meeting climate funding obligations

President Cyril Ramaphosa has expressed concern that the developed economies are still not meeting their obligations to support developing countries with the finance, technology and capacity building needed for effective climate actions.

In his weekly newsletter, following his attendance at the United Nations Climate Change Conference in Dubai, known as COP28, he said, “the operationalisation at COP28 of a fund to help vulnerable countries with loss and damage caused by climate change is a step in the right direction, but it will need substantial funding if it is to fulfil its purpose”.

He stated that funding through entities such as the Green Climate Fund and Adaptation Fund had been negligible. He is mindful that the discussions at COP28 have significant implications for South Africa. The impact of climate change is a measurable reality in South Africa, with poor, rural communities in particular bearing the brunt.

“For the transition to lower carbon economies to be just, affected communities cannot live on promises. Workers and communities currently dependent on coal and other fossil fuel industries need viable alternative livelihoods,” he said.

He outlined that as a country “in the midst of an energy crisis”, South Africa was aware that the pace of the just energy transition (JET) would be guided by developmental priorities.

He believes that South Africa’s JET Implementation Plan can ensure that effective action against climate change, while pursuing energy security for all, is possible.

“But if we are to implement these and the other actions outlined in the JET Investment Plan we – like all other developing economies – will require massive financial support from those countries whose development has been the primary cause of climate change. The countries that have contributed most to global warming must support those countries that now bear the brunt of its effects,” he said.

The plan announced at COP27 last year, outlines South Africa’s path towards reducing carbon emissions in the energy sector, which is the largest contributor towards the country’s total greenhouse-gas emissions.

The plan focuses on investment in electricity infrastructure, new energy vehicles, green hydrogen, skills development and municipal electricity distribution.

Ramaphosa stressed that the transition must be underpinned by engagement and partnership with workers, communities, business and civil society.

It also includes interventions to support affected communities, notably in Mpumalanga, “where most of our country’s coal-fired power stations are located”.

The President emphasised that the overriding message the South African delegation took to COP28 was that “our climate commitments will be implemented in a manner that both addresses our current energy crisis and strengthens our efforts to reduce poverty and unemployment”.

Large-scale garment manufacturing plant to boost local apparel

A partnership between a South African woman-owned textile company, IVILI Group, and the first dedicated gender focused investing Private Equity Fund in Africa, Alitheia IDF, is set to boost South Africa’s textile industry by increasing local manufacturing output, creating jobs and rebuilding skills in the sector through a $5million investment.

IVILI Group is made up of IVILI Loboya, one of Africa’s only wool and cashmere processing facilities, which is based at Ibika Industries in Butterworth in the Eastern Cape, and IVILITEX, a garment manufacturing factory located at the heart of the clothing and textiles industry in Cape Town.

IVILI Loboya was co-founded by South African social entrepreneur and global director of the International Women’s Forum, the late Dr Vuyokazi Mahlati.

IVILITEX recently opened its large-scale garment manufacturing plant in Epping, Cape Town where the initial production will consist of jeanswear for the local retailer market. The factory includes a jeans wash facility, with state-of-the-art technology imported from Spain, in partnership with Jeanologia, a manufacturer of technologies for the textile industry. The factory will leverage technology that allows the production and washing of garments with optimum levels of output and efficiency while maintaining low environmental impact.

IVILITEX aims to close the gap between locally made and imported apparel in the SA garment production industry by providing a solution for local retailers seeking locally manufactured garments on a large scale.

IVILI Group has set a target to become the leading textiles group in Africa while supporting local textile companies and aims to increase locally produced apparel for the local retail industry from the current 44% to 65% by 2030.

“For us being a pioneer textiles group on the continent simply means not compromising on quality and providing a technologically advanced sustainable product to the global markets,” said the Group’s CEO, Lilitha Mahlati.

Investor, Alitheia IDF, is a $102 million private equity fund which was co-founded by South African Polo Leteka and Tokunboh Ishmael from Nigeria. The partnership with the IVILI Group fits with the firm’s investment strategy of investing in a diversified portfolio of women-owned, women-led, or women-serving Small to Medium Enterprises (SMEs).

“We are the first private equity fund manager in Africa that prioritizes growth stage companies that have gender-diversified teams across the whole business value chain with the vision and potential to scale regionally and drive economic and social transformation,” said Leteka.

The government has consistently identified the clothing and textile sector as a strategic priority due to the labour intensity of manufacturing and its potential to support sustainable industrialisation, low- and semi-skilled employment and export growth.

“Our operations are built to eventually cover the entire value chain of textiles through the local harvesting and production of raw materials, to the production of semi-processed textiles products and finally producing apparel and other products for sale as finished goods in the retail market,” Mahlati said.

Large-scale garment manufacturing plant to boost local apparel – Cape Business News (cbn.co.za)

Karpowership receives long-awaited enviro approval for Richards Bay powership

Following much contestation from environmental groups, Turkish energy company Karpowership’s South African subsidiary has succeeded in getting environmental authorisation for its Richards Bay environmental-impact assessment (EIA) application.

This represents a critical milestone in Karpowership’s participation in the Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP) and towards reaching financial close on the project.

The group has been seeking to implement three ship-based floating gas-to-power projects on the South African coast for more than two years after being named a preferred bidder in the RMIPPPP.

Karpowership had three projects approved as preferred bidders under the RMIPPPP in March 21; however, it has been experiencing prolonged regulatory setbacks in getting the projects to financial close.

The environmental licences on the three projects, earmarked for the ports of Richards Bay, Saldanha Bay and Ngqura, are the only outstanding licences required to get the projects going.

Karpowership had undertaken multiple public participation processes and submitted multiple EIAs, which failed to meet the requirements previously.

The company is confident that the projects could be delivered within 12 months of achieving financial close.

Using imported liquefied natural gas as a fuel source, the powerships will each entail between 320 MW and 450 MW of capacity being transmitted to substations on the shore.

Various environmental organisations had been objecting to the implementation of another expensive fossil fuel-based solution, particularly because it was based near port communities, such as small-scale fishers, and because it might impact on marine life.

Another point of issue had been the 20-year contract length specified by the State in the RMIPPPP, with critics questioning why the country should be tied to an “emergency” option for so long.

The RMIPPPP, launched in 2020, aimed to procure 2 GW of additional power within 12 to 18 months, but very few of the awarded projects reached financial close within the timeframe.

Of the 11 RMIPPPP preferred bidders, only five projects have started construction.

Meanwhile, Karpowership said the Department of Forestry, Fisheries and the Environment’s decision to grant environmental authorisation for the Richard’s Bay EIA not only vindicated the company’s thorough EIA methodology and process but also demonstrated government’s willingness to objectively evaluate the information at hand.

The decision also further justified that powerships exceeded both international and South African environmental standards, the company stated.

Moreover, Karpowership envisioned dedicating R6-billion to economic development in Richards Bay over the life of the project through various job opportunities and socioeconomic initiatives.

To now meet financial close, Karpowership has to finalise agreements with Transnet National Ports Authority.

Karpowership receives long-awaited enviro approval for Richards Bay powership

(engineeringnews.co.za)

Imminent electric vehicle policy makes auto industry jittery

SA’s transition towards electric vehicles is a critical step, says the automotive industry.

South Africa’s imminent national policy on new energy vehicles (NEVs) is a step in the right direction; however, the automobile industry is concerned about its lack of emphasis on stimulating consumer demand for NEVs.

This was the word from Mikel Mabasa, CEO of the National Association of Automobile Manufacturers of SA (NAAMSA), speaking to ITWeb on the side-lines of the recent SA Auto Week event, organised by NAAMSA, also known as the Automotive Business Council.

The transition towards NEVs is a critical step to secure the future of the automotive industry in SA, so the policy should speak to the current barriers to adoption, he explained.

The long-awaited EV policy is expected to be delivered next week, when finance minister Enoch Godongwana tables the Medium-Term Budget Policy Statement in Parliament on 1 November, according to Mabasa.

The industry has over the years made several calls to urge government to hasten the policy. It warned that the lack of a regulatory framework could result in SA facing the threat of losing significant investment from local multinational players, such as BMW, Toyota and Mercedes-Benz SA – which have announced local plans for EV production and sales.

In 2021, the Department of Trade, Industry and Competition (DTIC) announced the Auto Green Paper, which focuses on the advancement of NEVs and battery-electric vehicles in SA.

In May 2021, the draft policy was gazetted for public comment and the policy proposals were submitted to Cabinet for consideration by October 2021.

While NAAMSA believes there has been progress on some of the policy statutes over the years, it believes there is room for improvement, particularly regarding commitment from government to enable a conducive market for increased adoption of NEVs.

“We are awaiting the formal policy pronouncements from the minister of finance on 1 November and later from the minister of trade, industry and competition, to better understand the commitments government is prepared to make.

“We do know that currently government will be announcing their stimulation support to promote production of NEVs in the country, but they are not talking about consumer demand stimulation and how they will support consumer demand.

“While we are encouraged that something is happening, we are not happy that there will only be one element of the announcement, which supports only the supply and leaves out the demand element, because we believe the two should be complementary,” commented Mabasa.

While several due processes should take place before the policy is enacted into law, NAAMSA believes in the interim, sufficient budget should be allocated to the industry to create a solid foundation for the roadmap to implement the NEV policy.

This should include funding for the local manufacturing of NEVs, as well as incentives such as tax exemptions for imported NEV vehicles and components, which will in turn boost consumer adoption, according to Mabasa.

Delivering a presentation at SA Auto Week, NAAMSA president Neale Hill emphasised the importance of a balanced policy that focuses on the supply stimulation element for automotive businesses, as well as demand stimulation from a consumer perspective. According to NAAMSA, the local automotive industry employs 497 408 people formally and informally, which is 2.9% of the 16.2 million people employed in SA.

SA’s auto industry also exports products to 152 markets and generated R227.3 billion in export revenue for the country last year, it says.

Imminent electric vehicle policy makes auto industry jittery | ITWeb

Automaker Stellantis to invest R3bn in South Africa

With the Industrial Development Corporation (IDC) and the Department of Trade, Industry and Competition (the DTIC), global automotive manufacturer Stellantis has confirmed its intention to develop a greenfield manufacturing facility in Coega situated near Gqeberha in the Eastern Cape.

Seated from left to right: Ebrahim Patel, Samir Cherfan | Standing from left to right: Kwezzi Tiya, Malebo Mabitje-Thompson, Imran Sayed, Leslie Ramsoomar | Source: Supplied

Minister Ebrahim Patel, senior officials from the IDC and Samir Cherfan, Stellantis Middle East and Africa chief operating officer, met at the parliament buildings in Cape Town to agree on investment in the South African motor industry.

The greenfield manufacturing project is planned to be completed by the end of 2025.

The first launch planned for early 2026 is a one-ton pick-up truck with volumes expected to reach up to 50,000 completely knocked down (CKD’s) units annually including export, in line with the industry masterplan, the Automotive Production Development Program (APDP).

The plant will be predisposed in terms of space and painting to go up to 90,000 units/year.

“Direct employment to support the first capacity step is expected at 1,000 jobs.

“Stellantis will be massively investing in over 500,000 hours of training and skills to develop and support the local teams to the level of global standards.

“We are targeting a localisation rate over 30%,” Stellantis said in a statement.

Khwezi Tiya, CEO of the Coega Development Corporation (CDC), said:

This is a much-needed and welcomed economic boost for the Eastern Cape Province with an anticipated economy-wide impact on the province’s GDP of R664m.

Household income is anticipated to increase to R558.4m within the Nelson Mandela Bay Municipality (NMBM) and R577.4m or the entire province.

Most importantly, an anticipated 1,800 jobs will be created in the Metro and around 2097 for the EC Province.

The CDC is enthralled for Stellantis to have chosen the proposed site in Coega for their Southern African manufacturing operations.

Joining other major manufacturers in the area makes the Coega region the primary automotive hub in the country.

The investment in the plant, employment, training and skills transfer will certainly benefit the region tremendously.

“It is a wonderful day for all South Africans when a global company of Stellantis’ proportions decides to expand its manufacturing footprint in South Africa, to assemble completely knocked down units,” said Ebrahim Patel, Minister of Trade, Industry and Competition.

“South Africa currently has the capacity to produce close to 700,000 vehicles annually. This will add considerable additional capacity, just as we prepare to implement the African Continental Free Trade Area.

“The country remains a great investment destination and this commitment from Stellantis to invest in our local motor industry highlights the success of our manufacturing sector policy, its capability and potential. We look forward to welcoming Stellantis to South Africa and sharing in the detailed plan for employment and investment,” Patel said.

Automaker Stellantis to invest R3bn in South Africa (bizcommunity.com)

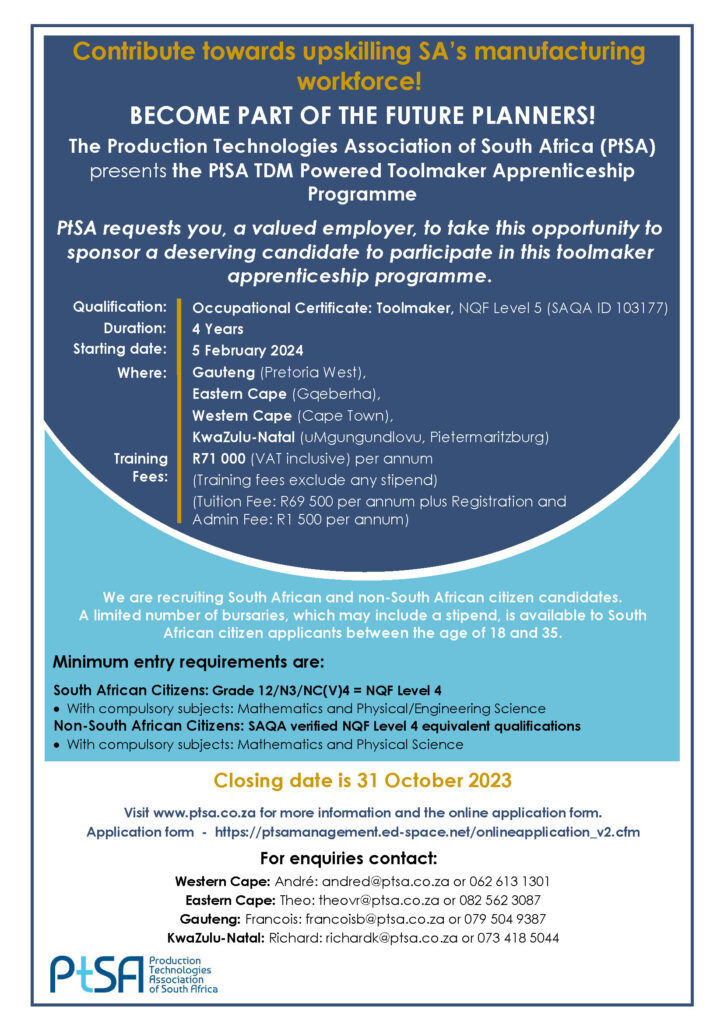

Contribute towards upskilling SA’s manufacturing workforce!

Nestle increases local sourcing in South Africa with new processing plant

Swiss food company Nestle said on Tuesday it would be locally sourcing over 40% of raw materials for a new processing plant in South Africa to offset supply chain challenges and cut costs.

Nestle opened a processing unit for its coffee brand Nescafe on Tuesday in Hamanskraal. Source: Supplied.

Nestle opened a processing unit for its coffee brand Nescafe on Tuesday at its factory in Hammanskraal near the capital Pretoria as it moves to tap into an increasing demand for coffee consumption in South Africa.

Massive slump

Nestle had said last month that it was ramping up local raw material sourcing in Nigeria and other African countries to reduce foreign exchange exposure. Food producers in South Africa have been hit by a combination of long hours of power cuts forcing them to run expensive diesel generators and a massive slump in domestic currency making imports dearer.

Nestle increases local sourcing in South Africa with new processing plant (bizcommunity.com)