News

General News

How AI and blockchain can shape sustainability

The convergence of technological advancements such as AI, blockchain technologies, and digital currencies with the global shift towards decentralisation presents a powerful opportunity to drive positive environmental, social, and governance (ESG) impact.

These innovations, combined with the principles of decentralisation, can revolutionise how businesses approach sustainability and create lasting value for all stakeholders. This article will explore how embracing AI and blockchain technologies can lead to significant advancements in ESG practices, fostering a more sustainable and responsible future.

Artificial intelligence (AI) has the potential to revolutionise ESG practices, enabling companies to analyse vast amounts of data, optimise resource utilisation, and make informed decisions that benefit the environment and society. By leveraging AI-driven algorithms, businesses can identify and address environmental risks, reduce energy consumption, and enhance operational efficiency.

AI-powered predictive analytics can facilitate early detection and mitigation of environmental impacts, enabling companies to proactively address climate change, resource depletion, and pollution. Moreover, AI can support social impact initiatives by enabling organisations to analyse social trends, identify areas of inequality, and develop targeted solutions that uplift marginalised communities.

How AI and blockchain can shape sustainability (bizcommunity.com)

Electric cars: Chinese carmakers are outpacing German giants

China’s carmakers have every reason to smile© Provided by DW – South Africa.

A sense of crisis is spreading in the German economy as order books look thinner and consumer purchasing power dwindles amid rising inflation.

The country’s car manufacturers are also facing headwinds but theirs are magnified by rising structural problems in the once-powerful industry. The transition to electric mobility and autonomous driving is causing higher costs, while the necessary funds, still coming mostly from sales of combustion engine vehicles, are increasingly uncertain, not to mention politically undesirable.

Company figures for the first half of 2023 were satisfying for the likes of Volkswagen, Mercedes Benz, and BMW. All of them reported increased revenues and higher profits. But their outlooks for the resr of the year have disappointed the expectations of investors and shareholders. Inflation and rising interest rates are having a dampening effect, and new vehicles are in less demand.

Electric cars: Chinese carmakers are outpacing German giants (msn.com

PtSA news letter June/July 2023

Loading…

Loading…

Local Manufacturing Webinar – Tapiwa Samanga

Manufacturing production in South Africa increased by 4.0% in March 2023 compared with February 2023. The largest contributions were made by the food and beverages sector, petroleum, chemical products, rubber and plastic products. How can we increase manufacturing output in our country? Proudly SA hosted a webinar discussing local manufacturing, unpack government programmes for local SMMEs, and the journey of getting your products approved for retail shelves.

Proudly South African seeks to influence local procurement in the public and private sectors, to increase local production and to influence consumers to buy local to stimulate job creation. This is in line with the government’s plans to revive South Africa’s economy so that millions of jobs can be created, and unemployment can be reduced.

Transcript of the webinar: please contact Liza du Plessis at lizadp@ptsa.co.za

South Africa can’t afford to kick grid investment can down the road – Ramokgopa

2nd July 2023

By: Terence Creamer

Creamer Media Editor

Electricity Minister Dr Kgosientsho Ramokgopa argues that South Africa should give urgent attention to the strengthening and expansion of the transmission grid to avoid any further extension of the prevailing loadshedding crisis, which he says has its genesis largely in the failure of government to respond timeously to the need to add new generation capacity.

“We can’t kick the can down the road in a similar manner as we did with generation,” Ramokgopa said of transmission grid investment during his weekly briefing on the implementation of the Energy Action Plan.

He argued that there were positive signs that the generation supply/demand imbalance was beginning to stabilise, with coal fleet breakdowns having moved to within touching distance of the key 15 000 MW level during the past week, and with demand peaks having remained well below, at about 30 000 MW, the 34 000 MW peak initially assumed when Eskom released its winter plan.

However, the lack of grid infrastructure, particularly in the wind- and solar-rich south-western provinces of the country, was now posing a serious risk to future security of supply, as it meant that renewables plants were struggling to connect to the grid.

The absence of such capacity came to the fore during the sixth bid window of the country’s public renewables procurement programme when none of the 23 onshore wind projects that bid for a 3 200 MW allocation were selected as preferred bids, owing to claims of grid over-subscription in the Western, Eastern and Northern Cape provinces.

“[In the area of generation], we kicked the can down the road as policymakers and we’re sitting with this [current] problem . . . so, we shouldn’t make the same mistake on transmission and think that we can resolve transmission sometime in the future.

“Transmission must be resolved today.”

He stressed, too, that the prevailing lack of investment in the grid was not a consequence of inadequate planning, with Eskom having drafted a credible Transmission Development Plan, but was rather a financing challenge.

The latest TDP points to the need for the construction of 14 218 km of new high-voltage transmission lines by 2032, as well as the deployment of 170 transformers, with a capacity of 105 865 MVA, along with 40 capacitors and 52 reactors.

Highlighting that Eskom was restricted by the National Treasury’s R254-billion debt relief package from taking on new borrowing, Ramokgopa said “more innovative ways” were required to overcome the funding issue.

A report was being finalised on the matter and would outline ways government intended tapping private sector liquidity without creating conditions whereby the State relinquished ownership of the grid, or whereby the system operator relinquished responsibility for grid management.

The report, he said, was far advanced in its drafting and would be shared once it had been through the necessary approval processes.

“It’s going to be revolutionary,” Ramokgopa assured, having previously given an indication that various build, operate and transfer models were being assessed.

The Minister also confirmed that he would be meeting with private wind and solar developers in the coming weeks to understand their concerns with Eskom’s recently unveiled Interim Grid Capacity Allocation Rules.

The rules, which replace the ‘first come, first served’ framework that has hitherto prevailed with a ‘first ready, first served’ approach, give priority to so-called shovel-ready projects in an effort to avoid any hogging of scarce grid resources.

However, the rules have been described as onerous by various bodies representing wind and solar stakeholders.

“I will be taking time within the next two weeks to sit with some of the players there to hear what the issues are,” the Minister said.

SA factory managers downbeat as sales orders slump

An index tracking business conditions in South Africa’s manufacturing sector edged up last month, but purchasing managers remained downbeat as new sales orders slumped.

The gauge, which measures expected business conditions in six months’ time, rose to 49.8 from 48.1 in March, Absa said on Wednesday.

“Despite the improvement, the index failed to edge back above the neutral 50-point mark as business activity and new sales orders worsened relative to March,” the lender said.

“The headline PMI would have deteriorated further if not for a significant improvement in the inventories index. The underlying survey results suggest that the sector experienced another tough month.”

South Africa is suffering its worst bout of electricity rationing yet, with state-owned utility Eskom implementing rolling blackouts —locally known as load-shedding — on more than 200 days last year and almost every day so far in 2023. The outages, which are needed to protect the grid from collapse when Eskom’s plants can’t meet demand, are curbing activity and demand in Africa’s most industrialised economy.

An inventories sub-index rose to its highest level since mid-2022, which could be an indicator that supply chains are working more effectively, according to Absa.

“On the demand front, new sales orders moved down more decidedly than output and reached the worst level since September 2022,” with the sub-index declining to 44.3 from 48.5 in March, it said.

The manufacturing sector accounts for about 14% of South Africa’s gross domestic product.

SA factory managers downbeat as sales orders slump | Business (news24.com)

Momentum

The Science of Safety

At Momentum Insure, we strive to offer certainty for what matters most, when it matters most – keeping you and your loved one’s safe. To help you be and feel safe, we’ve got 3 proactive safety pillars to instil a sense of confidence that will enable you on your success journey.

- checkPersonal safety: Protecting you and those you hold dear, wherever you are.

- checkRoad safety: Keeping you and your loved ones safe on the road.

- checkSafety at home: Keeping your most precious things safe, even when you aren’t home.

Benefits and rewards

Welcome to a world of benefits and rewards with Momentum Insure. Here’s how we reward and keep you, your loved ones, and the things you love safe:

- checkEarn up to 30% cashback, every year even if you claim, when you register for our Momentum Safety Returns rewards program and activate our safety-related features, on the Momentum App. Available to car and home insurance policyholders, at no additional cost.

- checkSafety Alert provides free assistance at the touch of a button on the Momentum App whenever you or someone close to you feels unsafe.

- check24-hour assistance with Momentum Assist for roadside, home, legal, and medical emergencies.

Car and home insurance

Get a quote for short-term insurance that protects all that’s important to you in South Africa. At Momentum Insure, we protect more than just your car, home, and hard-earned personal belongings, we protect you and your loved ones too. As our client, here are some of the benefits and rewards you can enjoy:

- checkUp to 30% cash back with Safety Returns, every year, for being safe.

- checkInnovative technology with Momentum Safety Alert, a panic button feature available at the touch of a button.

- checkFree 24/7 home, and roadside assistance wherever you are, including legal and medical emergencies with Momentum Assist.

South African economy expands by 0,4%

South African economy expands by 0,4%

After contracting by a revised 1,1% in the fourth quarter of 2022, real gross domestic product (GDP) edged higher in the first quarter of 2023 (January‒March), expanding by an estimated 0,4%.1 The manufacturing and finance industries were the major drivers of growth on the supply side of the economy. The demand side was lifted by exports, with smaller positive contributions for household, government, and investment spending.

Manufacturing and finance were the main drivers of growth

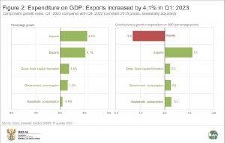

Eight of the ten industries recorded growth in the first three months of the year (Figure 1), with manufacturing and finance, real estate & business services the largest positive contributors. Manufacturing output increased by 1,5%, adding 0,2 of a percentage point to GDP growth. The production of food and beverages was the main catalyst behind the industry’s positive showing. Finance, real estate & business services crept up by 0,6%, mainly driven by financial intermediation, insurance & pension funding, real estate and business services. Personal services increased by 0,8%, driven by increased activity in community services. A rise in rail freight and rail passenger transport helped the transport, storage & communication industry expand by 1,1%. Air transport, transport support services and communications also witnessed stronger economic activity, contributing to the industry’s positive reading. After a disappointing end to 2022, mining activity turned positive in the first quarter. The rise in production was led by platinum group metals and gold. The trade industry also registered upward growth, with positive results from wholesale trade, retail trade and catering & accommodation. Motor trade wasn’t as lucky, however, recording a decrease in economic activity. Electricity, gas & water and agriculture contracted in the first quarter. Electricity, gas & water (utilities) registered its fourth consecutive quarter of decline, dampened by weaker electricity production and lower water consumption. The decline in utilities in the first quarter was an improvement from the decrease recorded in the previous quarter. Agriculture slumped by 12,3%, weighed down by a decline in the production of field crops and animal products. Agriculture was the largest negative contributor in the first quarter, subtracting 0,4 of a percentage point from GDP growth. Exports the main positive contributor to expenditure on GDP Stats SA also measures the expenditure side of GDP, providing an indication of total demand in the economy. This includes measures of government consumption, household consumption, investment (gross fixed capital formation and changes in inventories), and net exports. South African exports were buoyant in the first quarter, expanding by 4,1% (Figure 2). Export growth was mainly driven by increased trade in base metals, food (vegetable products, prepared foodstuffs & beverages) and machinery & electrical equipment.

Mirroring the rise in construction on the supply side of the economy, gross fixed capital formation increased on the back of government investment. While the private sector and public corporations made smaller positive contributions, their impact was not on the same scale as government. Households increased spending on restaurants & hotels by 6,9%. This budget item was the largest positive contributor to the 0,4% rise in overall household consumption expenditure. Imports were also up in the first quarter, mainly driven by increased trade in machinery & equipment, chemical products, vehicles & transport equipment, and prepared foodstuffs & beverages.

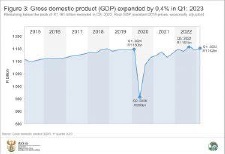

GDP: a time series

Those familiar with GDP media briefings may recognise Figure 3. Updated for the first quarter, the graph provides a quick overview of how the economy has performed since 2015. After the sharp downturn in the second quarter of 2020, real GDP (constant 2015 prices) took two years to return to pre-pandemic levels. In the third quarter of 2022, real GDP reached an all-time high of R1 161 billion.

For more information, download the latest GDP release, media presentation and Excel files here. 1 The quarter-on-quarter rates are seasonally adjusted and in real (volume) terms (constant 2015 prices). Similar articles are available on the Stats SA website and can be accessed here. For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.

Productivity SA Research Reports Seminar

Loading…

Loading…

PetroSA is ‘helping Eskom reduce power cuts’

Cape Town – Petro SA, a state-owned company in South Africa that imports diesel, has noted a surge in demand for fuel due to frequent power outages. However, the market remains well supplied, leading to a downward trend in prices, thanks to increased international supply from different regions.

PetroSA has been focused on assisting Eskom, the national power utility, to ensure a steady supply of diesel at affordable prices to combat the impact of load shedding. According to SABC, Vusi Xaba, Petro SA’s executive of trade and supply, says that the company employs strategies such as floating additional ships to stabilise Eskom’s expenditure and protect it from higher pricing.

PetroSA denied allegations of overcharging Eskom for diesel, emphasising its commitment to supporting energy security in the country.

This week, the Minister of Electricity Kgosientsho Ramokgopa said that power ships would be a crucial part of the country’s emergency energy procurement. Speaking at the Enlit Africa Energy Conference, Ramokgopa emphasised the government’s efforts to stabilise the electricity grid. He stressed the importance of bringing additional energy sources online quickly to alleviate the burden of load shedding. “Essentially generation mounted on the ships, it takes them on average about three months to get it on stream. We have to get those things on stream as quick as possible,” EWN quoted Ramokgopa as saying.

Ramokgopa assured that environmental requirements would be met during the implementation of power ships. He clarified that he was referring to power ships as a solution in general, rather than specifically mentioning the company Karpowership. “I’m talking about power ships, I’m not talking about Karpowership as a company, but a solution. I think it’s important that you know that so that we are able to reduce the stages of load shedding. There is no self-respecting country that folds its arms and watches the economy collapses when in fact there are solutions that exist,” he said.

Additionally, Ramokgopa highlighted the need for grid capacity expansion, stating that Eskom would need to install 14 000km of power lines to meet future demand projections. According to eNCA, the minister said that rolling blackouts had the potential to cripple the economy.

“The problem statement in short is that load-shedding has got the capability of crippling the South African economy and undermining the progression of this democracy that we term the rainbow nation,” he said.

Petro SA steps in to help Eskom reduce higher stages of load shedding (africaninsider.com)